In today's digital age, managing your finances has never been easier, especially with the advent of mobile banking applications. One of the most crucial aspects of banking in Nigeria is your Bank Verification Number (BVN), which is essential for securing your account. Knowing how to check your BVN on the GTBank app can save you time and provide peace of mind. This article will walk you through the steps to check your BVN, the importance of BVN, and other related information.

BVN serves as a unique identifier for bank customers in Nigeria, aiding in fraud prevention and promoting transparency in financial transactions. With the GTBank app, customers can easily access their BVN without the need for lengthy procedures or waiting in line at the bank. This convenience is particularly beneficial for those who are always on the go and prefer managing their finances from the comfort of their devices.

In this guide, we will cover everything you need to know about checking your BVN on the GTBank app, including step-by-step instructions, FAQs, and additional tips to enhance your banking experience. Whether you're a new customer or a long-term user, this comprehensive resource is designed to assist you in navigating the GTBank app with ease.

Table of Contents

- What is BVN?

- Importance of BVN

- How to Check BVN on GTBank App

- Troubleshooting Common Issues

- Security Tips for Using GTBank App

- Frequently Asked Questions

- Conclusion

- Call to Action

What is BVN?

The Bank Verification Number (BVN) is an 11-digit unique code assigned to every bank customer in Nigeria. It acts as a biometric identification system that links all of a customer's bank accounts to a single BVN. This system was introduced by the Central Bank of Nigeria (CBN) to enhance security and reduce fraud in the banking sector.

Key Features of BVN

- Unique identifier for every bank customer

- Links multiple accounts to a single BVN

- Enhances security and reduces fraud

- Required for accessing various banking services

Importance of BVN

The BVN plays a crucial role in the Nigerian banking system for several reasons:

- Security: BVN helps to prevent identity theft and fraud.

- Access to Services: Many banking services require a BVN for eligibility.

- Account Linking: Customers can link all their bank accounts to one BVN, simplifying management.

- Regulatory Compliance: BVN is a regulatory requirement set by the CBN.

How to Check BVN on GTBank App

Checking your BVN on the GTBank app is a straightforward process. Follow these steps to retrieve your BVN:

Step-by-Step Guide

- Download and install the GTBank app from the Google Play Store or Apple App Store.

- Open the app and log in using your credentials.

- Once logged in, navigate to the 'Menu' option.

- Select 'Profile' from the drop-down menu.

- Click on 'BVN' to view your Bank Verification Number.

It’s that simple! You will have immediate access to your BVN without the need to visit a bank branch.

Troubleshooting Common Issues

If you encounter any issues while trying to check your BVN on the GTBank app, consider the following troubleshooting tips:

- Ensure your app is updated to the latest version.

- Check your internet connection for stability.

- Log out and log back into the app to refresh your session.

- If the problem persists, contact GTBank customer service for assistance.

Security Tips for Using GTBank App

To safeguard your banking information while using the GTBank app, follow these essential security tips:

- Use a strong password and change it regularly.

- Enable two-factor authentication for an extra layer of security.

- Avoid using public Wi-Fi networks for banking transactions.

- Regularly monitor your account for any unauthorized transactions.

Frequently Asked Questions

Here are some common questions about checking BVN on the GTBank app:

1. Can I check my BVN without the GTBank app?

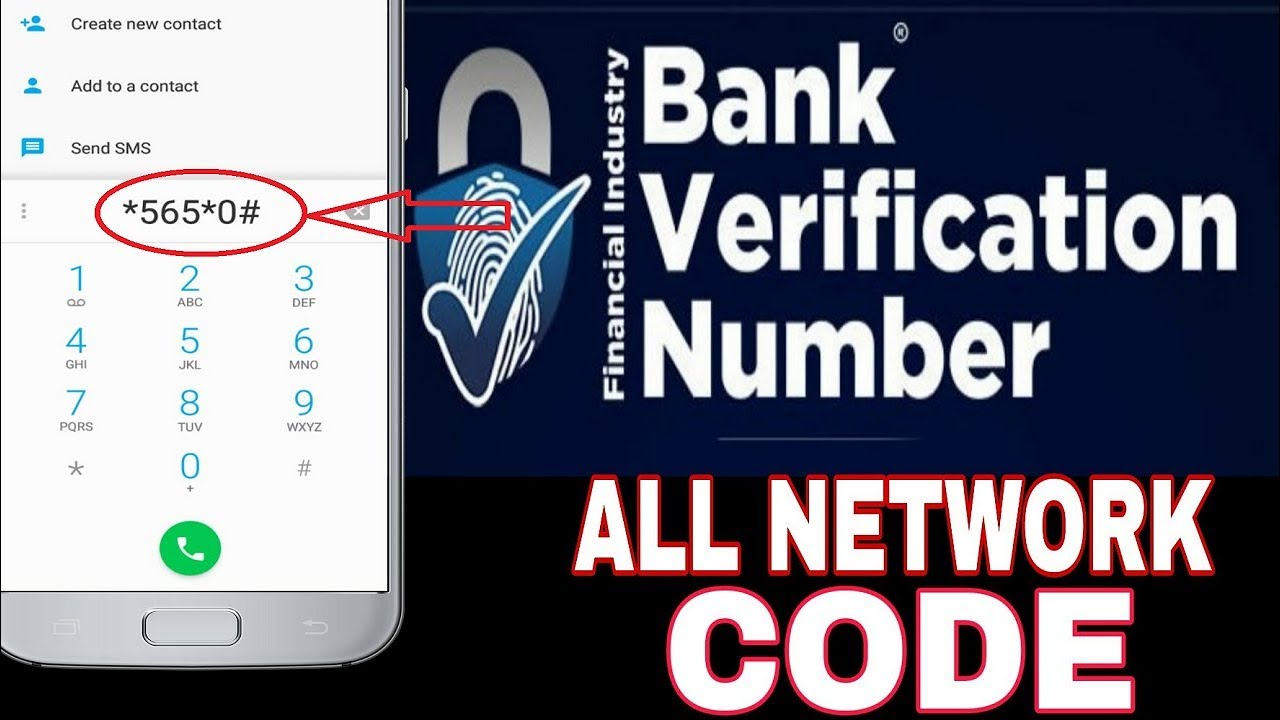

Yes, you can check your BVN by dialing a USSD code or visiting your bank branch.

2. Is there a fee to check my BVN on the GTBank app?

No, checking your BVN using the GTBank app is free of charge.

3. What should I do if I forget my GTBank app password?

You can reset your password using the 'Forgot Password' feature on the app.

Conclusion

In conclusion, checking your BVN on the GTBank app is a quick and easy process that enhances your banking experience. By following the steps outlined in this guide, you can access your BVN anytime and anywhere. Remember to keep your banking information secure and stay informed about your financial management.

Call to Action

We hope you found this guide helpful! If you have any questions or experiences to share, please leave a comment below. Don’t forget to share this article with friends and family who might benefit from it, and explore our other articles for more valuable insights!

Thank you for reading, and we look forward to seeing you back on our site for more informative content!

Also Read

Exploring The Allure Of The Sexy Thick Black AestheticHow Old Are The Actors In Young Sheldon?

How Much Does Ryan From Ryan's World Make?

What Is Yandy Smith Nationality? A Deep Dive Into Her Background

Logan Paul Height: Everything You Need To Know

Article Recommendations

- Nile Rodgers Children

- Twitter Rock Paper Scissors Yellow Dress Full Video

- Mcafee Security Scam

- The Cast Of Mash

- Bosworth Football

- P Diddy Flees To Africa

- Sotwe Gemoy

- And Adam Levine

- Taka One Ok Rock Wife

- Influencers Gonewul